International student loans are a popular topic of conversation, especially for those students looking for additional financing. While there are many lenders that loan to international students, each loan has its own terms and conditions that will influence how much you pay over the life of your loan.

In our previous blog, we defined what is the principal and interest rate. The interest rate, or the cost of borrowing money, is influenced by the amount of risk associated with the loan. As you increase the time period on your loan, the total risk of your loan being repaid increases, and therefore the interest rate will also be higher. The interest rate accrues on a daily basis which is determined by your interest rate, amount borrowed, and length of your loan.

And, given this information, let’s consider how this relates to the repayment period. So, what is the repayment period?

The repayment period is the act of returning money that you have previously borrowed. This includes the repayment of both your interest rate and principal that you were lent.

This is an important term since you will need to know when to make your loan payments to ensure that they are paid on time. If they are not, you could find that you will have additional associated fees for late payment, or your loan could be in default.

To avoid this, many students prefer automatic debits from their account to ensure that payment is made on time each month. In some cases, you will find that lenders will reduce your interest rate if you sign up for electronic debiting.

There are three main forms of repayment:

This form of payment is typically much easier for students who want to dedicate their time in school to just studying. This allows students to defer interest and principal repayments until after graduation (typically up to four years consecutively), or when the student drops down below part-time status. Payments will generally begin 6 months after graduation or if the student is no longer enrolled at least part time. Keep in mind that this is the most expensive option as interest will accrue during the deferment period and will be added to the balance at the time of repayment.

Another less expensive option is the interest only repayment option. This allows the student to begin paying back the accrued interest on your loan immediately, while you are in school, but your principal payments typically do not begin until 45 days graduation (up to four consecutive years) or once students drop below part-time student status.

This is the least costly option for students since students begin making payments for both the principal and interest immediately once the loan has been disbursed.

For further questions about repayment period, and why this matters, contact our loan experts. If you are interested in comparing international student loans, you can do so using our international student loan comparison tool which will allow you to compare basic lender terms.

The information provided in this blog is designed to highlight features of loans and how they work. It is always important to check with your lender to confirm terms and conditions, as they can vary.

Just when you thought the leading resource in international education financial aid couldn’t get better, it did. IEFA.org has recently had a facelift that includes new additions along with multiple updates to existing features making it a complete resource for finding the aid you need overseas, all in one spot.

IEFA has a new, polished look, but the main feature of this site still includes a scholarship database which holds over 900 awards for international students and those studying abroad. The IEFA relaunch includes updates of the most recent information to existing content, giving students a better chance of receiving aid! Instead of searching through hundreds of scholarships, awards can now be narrowed down by searching what students are studying, where students are studying or their origin and destination. The scholarship database is now continuously updated meaning less scholarship searching and more scholarship applying!

Although scholarships assist students with their financial needs, most of them do not cover every expense associated with international education. The IEFA relaunch now allows international students in need of a private loan access to the loan information they need with a user-friendly loan comparison tool. With multiple outlets of funding available, IEFA has become a complete resource for students looking to fund overseas education.

IEFA is also the new home of the IFAB blog. This content offers the most up to date information in the international education financial world. International students in need of tips or guidance along with their financial assistance will find this beneficial.

IEFA has been a valuable resource for international students for 14 years, with the IEFA relaunch they will now have access to even more comprehensive information and the financial aid they need.

If you are an international student interested in coming to the United States to study, or if you are currently enrolled in a US university or college, you may be looking for private sources of funding. While scholarships, grants and fellowships are a great place to start, you may soon realize that this is insufficient to cover your tuition, room and board, books, and other living expenses. Many international students turn to private student loans in this case.

If you are an international student considering a private student loan, there are a couple of pointers that you will want to know before applying for any loan.

1. Not all loans work for international students. Each lender has their own restrictions on eligibility. Some lenders only work with US citizens or green card holders, thereby eliminating any possibility of an international student obtaining a private student loan. Before you begin your application, be sure to check whether you are eligible before spending time gathering your information and completing the required documents.

2. Not all loans work for all schools. Private student loans have to be school-certified and thus only certain schools work with specific lenders. You will need to check with your lender to confirm that they work directly with the school you plan to attend – or the school you are currently enrolled in. Once you apply for a loan, the total loan amount is certified by your school. Loans are typically certified for the cost of attendance minus any other financial aid. The funds are then dispersed to your school that then disperse the funds to the international student.

3. Cosigner required. Most international students are required to have a US cosigner. That cosigner must be a US citizen or permanent resident that has lived in the United States for the last two years. To get the best available rate, your cosigner should have good credit history and rating.

For additional help in comparing lenders, check out our international student loan comparison tool that consider all of these factors to provide you with a list of eligible private student loan options. By choosing your school and citizenship, you will be given a list of lenders that have been prescreened based on your eligibility.

If you are planning to study overseas, you may find that going to school in a foreign country can be costly. While you will still have to cover your tuition, books, and living expenses, now you’ll need to factor in additional flight costs, exchange rates, health insurance, etc. While there is no doubt that studying overseas can help you become more competitive in the job market and advance your career, the immediate dent in your wallet could take a toll.

Whether you are an international, study abroad, or foreign enrolled student, you may – like many students – consider looking for external sources to help finance your education. But where should you look? Scholarships, grants, and loans are a great first step to get the funding you need:

Scholarships

Scholarships are a great way to fund your education since you do not need to worry about paying back the money you receive. Some schools provide scholarships to their students based on financial need, or based on your academic merit. Contact your school to determine the availability along with any requirements and deadlines that you may need to meet.

Additionally, there are scholarships that are provided by independent organizations based on a wide range of criteria. Ever heard about the travel video contest by International Student? They awarded $4,000 to the winner for their video describing why they want to study abroad. Because these scholarships are offered by independent organization, there are a wide range of opportunities as they are looking for students with special qualifications, such as academic, athletic or artistic talent.

Check out International Scholarships to begin the scholarship search.

Grants

Grants are typically granted to students based on financial need by a non profit organization, educational institution, government division, business or individual. The higher your financial need, the more likely you are to be awarded a grant – however this can be quite difficult for an international student.

Unlike scholarships that consider other factors such as field of study, qualifications, etc., grants require students to show that they need the grant based on academic need. However, like scholarships, once the money is dispersed, you do not need to worry about paying it back to the organization.

Check out International Education Financial Aid to see what grants are available.

Loans

Unlike scholarships and grants, international student loans are dispersed to those students who apply for the loan. Once the money is dispersed, you will be responsible for paying back the money you borrowed PLUS interest. Loans are typically easier to receive than scholarships and loans, but international students in the US will need to have a US cosigner in most cases who have spent at least 2 years in the United States.

Keep in mind that there are only certain lenders that will loan to international students. Eligibility will be determined not only lender, but also by school. Before beginning the application process, you may want to check to see if you are eligible. Our partner International Student Loan has also done this process for you where they compare lenders based on your eligibility.

Subscribe to our blog to get the latest information on financial aid.

As we head into the new academic year, many international students will be looking at international student loan options. Comparing loans is not easy, especially with bank terminology. One of the most important terms that will effect students is how much you are going to pay back over the course of your loan. Loans are repaid in two parts: principal and interest rates. See below for the principal and interest rate defined:

Principal

Principal is the total amount of money you were loaned. Let’s say you are planning to attend New York University and you took out a $30,000 loan to cover tuition, room and board, books, etc. This amount is what you have borrowed from the bank, and thus will be expected to pay back.

Interest Rate

There is a cost to borrowing, and this is known as the interest rate. This is the amount that you pay back to the bank on top of what you initially borrowed (the principal). Lenders typically have a range for the amount of interest they charge, which will depend on you (and your co-signer’s) creditworthiness. Typically this is expressed on an annual basis known as the annual percentage rate (APR) which will be finalized after your loan application has been submitted and reviewed. There are two types of interest rates that will be disclosed before you apply for a loan:

Most student loans are fixed rate interest, however many private student loans do offer variable interst rate. It is important to read the terms and conditions to know how the principal and interest rate are defined, how it will be determined, and how it may change.

It’s that time of year again! Many of you have enjoyed your winter vacation filled with holiday cheer and New Year celebrations. As you head back for Spring semester, you may realize that your holiday money did not exactly match the tab for your education. If this is your case, you may consider loans for Spring semester.

International Student Loan matches students will loans for their upcoming academic school semester. If you are an international, study abroad, or foreign enrolled student, you are not too late to apply for loans for Spring semester. To do this, you can simply compare your loan options, and apply right online.

You can apply for up to the total cost of education, as determined by your school, minus any other aid received. After you apply and receive credit approval for you and your co-signer, your school must certify the amount of the loan. The proceeds are then disbursed directly to the school. Most US students and international students must have a US co-signer thatis a US citizen or permanent resident with good credit and income history and who has lived in the US for the past two years.

Check the eligible school list to see if your school has been approved so that you can start applying for loans for Spring semester!

As more students decide to study overseas, financial aid plays a critical role for many students looking to make this a reality. Financial aid comes in many forms, including scholarships, grants, and loans. For many international students, even with the assistance of scholarships and grants, there is still a need to secure additional financing by taking out a loan.

Many international students have had difficulty finding lenders that will loan to international students. Some lenders require students to be a US citizen or permanent resident and all lenders work with specific school (and these lists of approved schools vary by lender). Because of this, many international students have to read through the terms and conditions or complete the application to see whether they meet the eligibility requirements for each lender.

This has all changed thanks to International Student Loan’s new loan comparison tool. This loan comparison tool takes all of this information into consideration to match international students with the right loan options instantly. International students simply indicate their school, citizenship, and whether they have a cosigner, and they will be given a list of lenders to compare that have been matched based on their eligibility. Once international students have chosen their loan, they can proceed to the application and apply for the loan directly.

International Student Loan’s Comparison Tool is making financial aid easier for students to study overseas, saving time and providing students with option to make studying abroad a possibility. For any questions on how this works, you can contact representatives at International Student Loan.

Funding for international students is a critical factor for any student looking to receive a degree or certification overseas. Think about it. Housing, food, tuition, and books are just a few of the necessary expenses students will need to consider when they budget for their education.

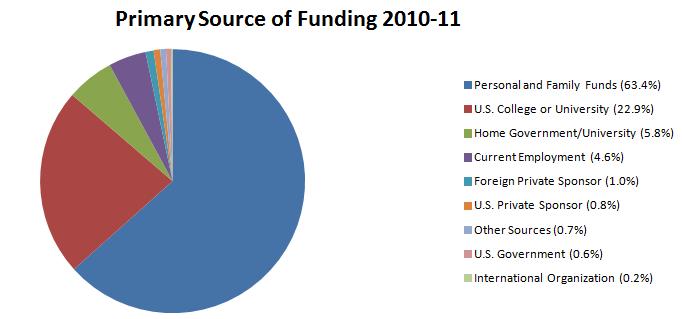

One way students reduce their costs is by applying for scholarships and grants. While many students hope for a full scholarship supported by their college or university, this can be a challenge. In fact, only 23% of international students in the US cover the majority of their expenses with assistance from their college or university. This is the largest external source of funding for international students (excluding self and family funding) – see the graph below that reflects funding for foreign students in the US.

The Institute of International Education publishes an annual report monitoring data on international students in the US called the Open Doors Report. This publication, released last month, confirmed that funding remained consistent over last year with relatively minor fluctuations. What does this means? In the 2010-2011 academic year 63% percent of international students primary funding for international students was by personal and family funds.

Here are some important tips for students looking to budget responsibly:

1. Know the cost of your education.

The initial budgeting stage for your education overseas is to know what expenses you can expect. You should be aware of costs that include your tuition, books, living expenses, etc. The Net Price Calculator can be a useful addition to develop an accurate budget.

Since October 29, 2011, in compliance with the Higher Education Opportunity Act of 2008, those colleges and universities who participate in Title IV federal student aid programs are required to estimate the cost of attendance for current and prospective students seeking a degree and/or certificate. The idea of the Net Price Calculator is to provide students with transparency on the cost of their education as well as any grants/scholarship awards they typically distribute to students. This tool will outline tuition and associated fees, books and supplies, room and board, personal expenses, transportation, grant aid, etc. Keep in mind that the tool was developed for US students so results may vary for international students, however this can be a good start!

2. Apply for scholarships and grants.

It is important for international students to apply for scholarships and grants to reduce their personal expenses. Be aware of programs, dates, and eligibility requirements, and add them to your calendar to stay on top of those awards that are distributed by your school. Funding for international students can also be found through your home country as well as non-profit organizations or third parties. You can use resources like International Education Financial Aid (IEFA) and International Scholarships to begin researching your overseas funding.

3. For additional financial assistance, you may need to apply for an international student loan.

Once you have maximized your scholarships and grants, you may consider looking for a loan for international students. If you have a US co-signer, you may be eligible for a US-backed loan that can help you support your education overseas. Be sure to read through the terms and conditions before you apply.

Student loans can assist you in supporting the many costs that you may incur as an international student. Keep in mind, however, that this aid is expected to be paid back along with interest. While funding for international students can vary, this may be a helpful alternative for students looking for financial assistance from a US bank.

Find a scholarship for international students in Canada.

One positive by-product of a relatively weak ecomony is the continuing low interest rates for international student loans for study in the USA. Interest rates for loan programs offered by International Student Loan range from 2.25% APR to 9.11% APR with no origination fees. When you consider that there is no collateral required for a student loan, unlike a home or car loan, it is impressive that student loan programs can operate at such rates. Since student loans are often based on LIBOR, a low LIBOR is certainly helping the situation.

Lenders offered through the loan center on InternationalStudent.com also offer excellent rates, and you can compare and contrast them. A quick search today showed current APRs beginning at 3.16%.

Private student loans are available for international students studying at approved schools in the United States. All international students need a US co-signer. The interest rate for each student is set by the loan underwriter based largely on the credit score and income history of the US co-signer, so a stronger co-signer can mean a lower rate. You can apply for up to the total cost of education, minus other aid received.

Check both options to figure out which works best for you and your school:

http://www.internationalstudentloan.com

http://www.internationalstudent.com/loans/

Subscribe to the International Financial Aid Blog to get an update for each new post.

Student loans are available for international students studying at approved schools in the United States and Canada. There are multiple loan programs available – today we will highlight the main two. International students are not eligible for US federal loans, for which you need to be a US citizen or permanent resident. However, the following two private loan programs are an excellent resource for non-US citizens:

InternationalStudentLoan.com – International Student Loan is the main online resource for school loans for international students, and has been for years. Currently, International Student Loan offers loans up to the total cost of education, as determined by your school, minus any other aid received. These loans are school certified (as all student loans are now), meaning your school financial aid office must certify the final amount of the loan to ensure that you are not borrowing more than you need. And the kicker – the school determines how much you need, based on their total cost of education minus any other aid you receive. The approved school list is quite long, meaning most US schools are approved for loans. With this loan program, interest payments are required while you are in school, with full repayment beginning 6 months after separation from school.

Find an international students loan in usa at https://www.InternationalStudentLoan.com

InternationalStudent.com – InternationalStudent.com is the primary portal site for international education, and on its loan page it features a loan comparison tool with multiple lenders. The school list is even longer, and you can find loans on the comparison tool that do not require any interest repayment while in school.

http://www.internationalstudent.com/loans/

Check them both to figure out which is the best financing option for you.