IEFA Blog

Can You Get Financial Aid For Studying Abroad

If you’re a student from the United States, you could be eligible for financial support through the standard federal FAFSA program, meaning studying at a foreign university may not be as difficult to finance as you’d imagined! You might want to study abroad as part of an exchange program for a semester or an academic…

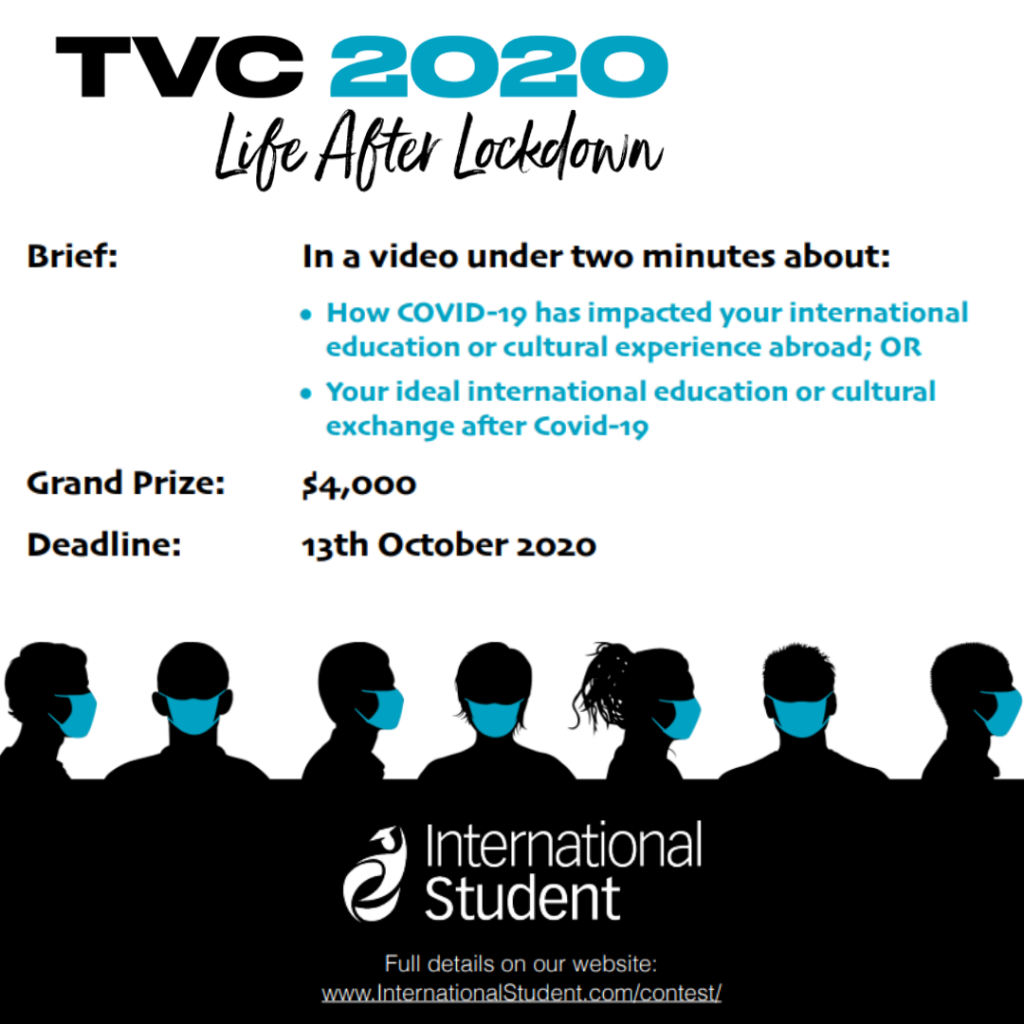

Life After Lockdown Travel Video Contest

For 15 years, InternationalStudent.com has been organising a contest for international students to create a video about an aspect of their life and their experiences or hopes of studying abroad. Despite the very different landscape for international student travel we’re experiencing in 2020, InternationalStudent.com is bringing the contest back – and this year it has…

IEFA Round Up: 8 2020

We don’t need to tell you that despite COVID-19 impacting in-person classes, exams and plans for just about everyone around the world, International Education doesn’t stand still for long. We’re excited about the start of the Fall Semester 2020. Here’s our roundup of some of the news in International Education that caught our attention August:…

How to find international or study abroad scholarships for 2021

Who Provides Study Abroad Scholarships? Scholarships can come from many different sources and you’re typically eligible to receive more than one form of financial support. Review the guidelines for each scholarship or award to see what opportunities you qualify for. There are various sources of funding for the financial aid, such as: Schools and Universities…

Studying in the United States vs. Canada

In this post we’re comparing studying as a foreign student in the USA with studying in Canada – if you’re interested in studying in either country then you’re in the right spot-as we will discuss some of the big advantages of studying in each. Now let’s dive straight in! Why you should think about studying…

Financial aid for international students in the U.S. explained

In this video we break down all the Financial Aid Opportunities for International Students in the US. If you’re specifically looking for a loan, then you can use the tool on our site to see if you are eligible. If you’re looking for a scholarship, then you can search through our database on our Scholarships…

Zuckerman STEM Leadership Program

The Zuckerman STEM Leadership Program supports future generations of leaders in science, technology, engineering, and math in the United States and Israel and, over time, fosters greater collaboration between the world’s most advanced scientific research centers. The program provides scholarships through the following initiatives: The Zuckerman Postdoctoral Scholars Program attracts high achieving postdoctoral scholars from…

Global Citizen Scholarship and Women in STEM Scholarship: Application Deadlines approaching!

We believe that everyone deserves the right to get a proper education as it creates a better world for all of us. What better way to turn that philosophy into reality by offering scholarships in the U.S. and Canada. Knowing that these two countries are some of the best places to study and get a…

Loans That Do Not Require a Cosigner in the U.S. and Canada

Loans Without a Cosigner for International Students in the U.S. If you are already, or are going to be an international student in the US, it will usually be required of you to have a cosigner while applying for a loan. If you do require a cosigner, the cosigner must be a US citizen or…

The 2018 InternationalStudent.com Travel Video Contest Winners Announced

The 2018 InternationalStudent.com Travel Video Contest winners have been announced! For all the ones who have been following the contest, you know that it wasn’t an easy decision for our judges since all the finalist videos were incredible, but they had to come with 3 winners. Today, the last day of International Education Week, we…

Get the Financial Aid Newsletter