The latest data covering international students in the USA and American students studying abroad has been released – here are the highlights:

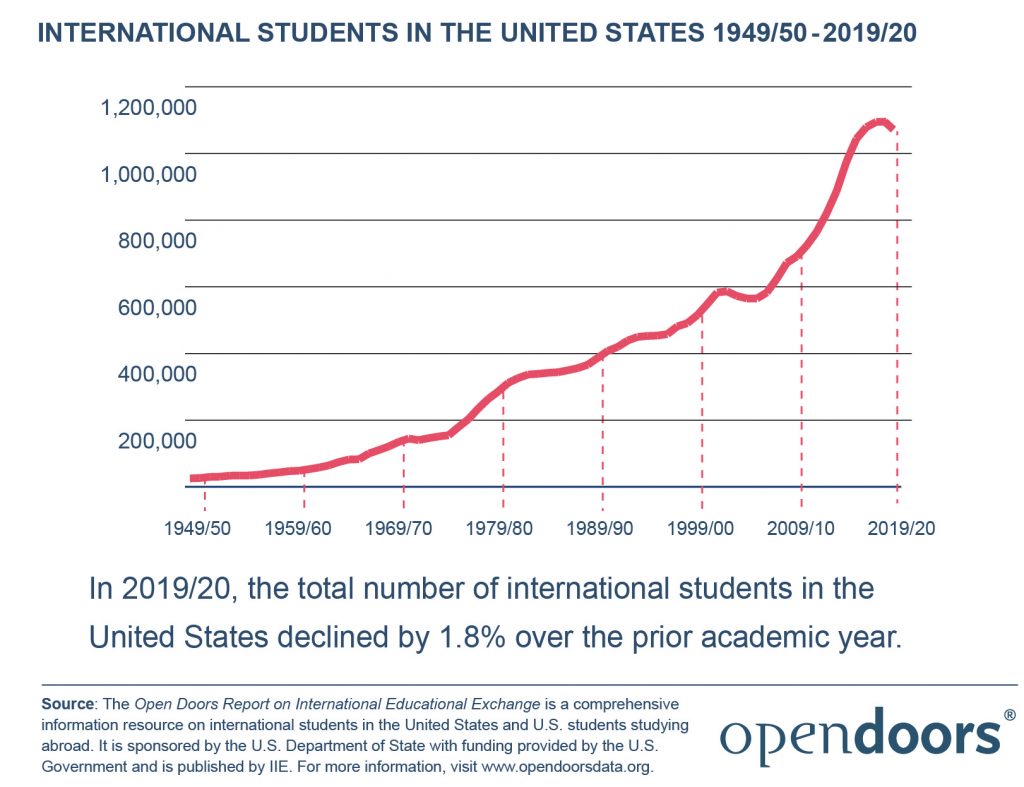

Over 1 million international students studied in the US in 2019/20, including those taking an academic program and those on OPT (Optional Practical Training).

That’s over 5% of the total number of enrolled students, but it is almost 2% (or 20,000 students) lower than the previous period. Early indications suggest that due to the pandemic international student enrolment in 2020 could be down by a further 16%.

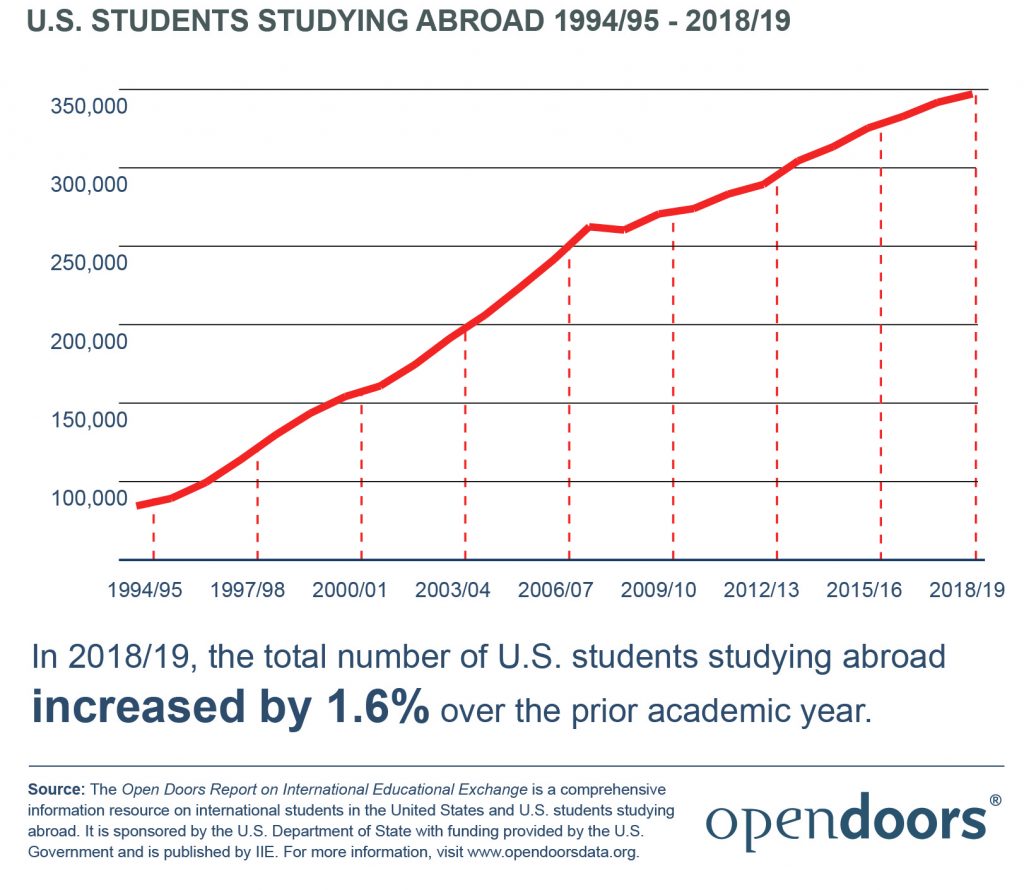

Almost 350,000 US students studied abroad for academic credit in the 2018/19 academic year (the latest data available).

That’s almost 2% higher than the previous year – continuing the trend which has only been increasing for over 10 consecutive years.

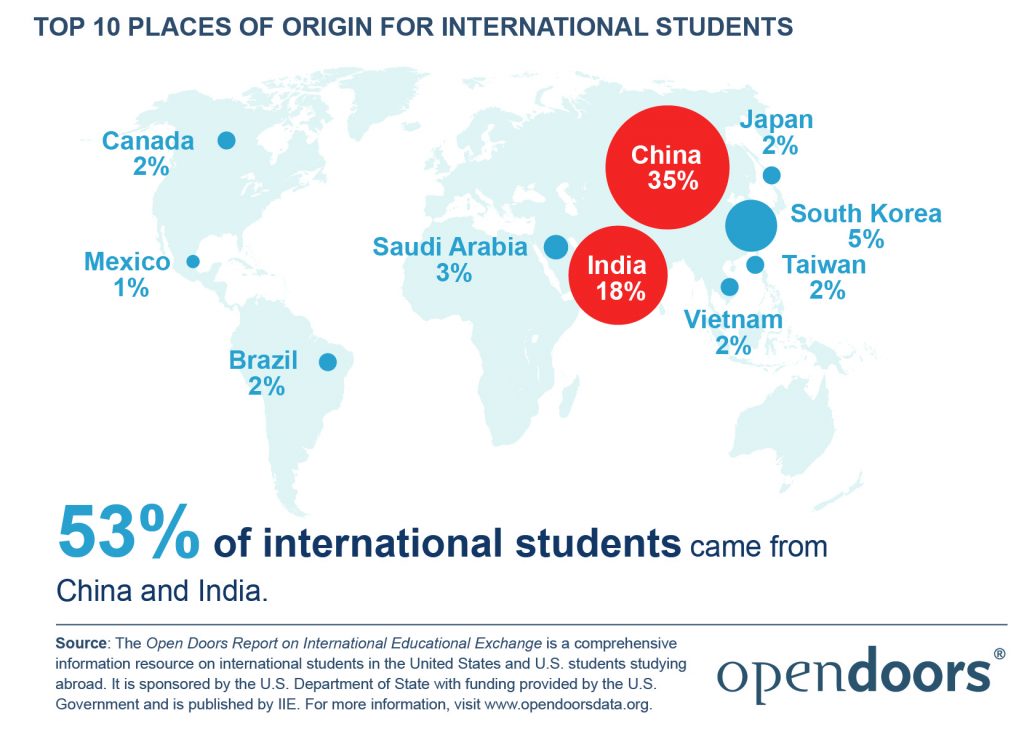

Incoming students to the US came mainly from China (35%) and India (18%).

The top 10 countries of origin for incoming students were:

California was the individual state that hosted the most international students in total (with over 160,000).

The single most popular institution in the US for international students was New York University – hosting over 20,000 students from around the world!

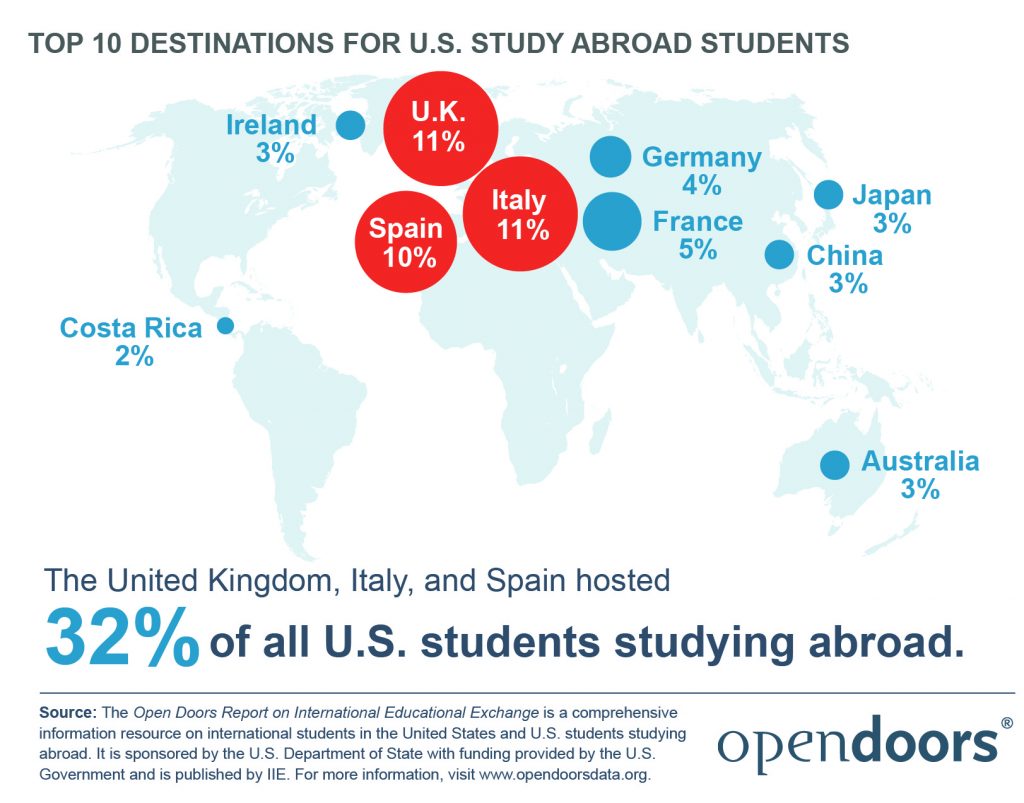

Outgoing US students’ top destinations were the UK (11%), Italy (11%) and Spain (10%).

The top 10 destination countries for US study abroad students were:

For more on this data please visit https://opendoorsdata.org/annual-release/

If you’re studying abroad you may be able to fund part of your education with a loan:

Read more on the blog.

Or search our scholarships listings.

CAN INTERNATIONAL STUDENTS GET SCHOLARSHIPS?

Many colleges and universities around the world offer scholarships for international students as part of their financial aid packages. If you’re studying outside of your home country, you should definitely see if there are scholarships for international students available at the school you will be attending.

An international scholarship will help to offset the cost of attendance at a university abroad.

More than one million international students study at U.S. colleges and universities every year. With many more studying in other countries around the world, too.

Universities and private sponsors offer a wide array of programs with various amounts for tuition and fees. Many schools offer international student scholarships in order to attract a diverse range of students to study at their institution.

Getting a study abroad scholarship can make a huge difference if you want to study in another country. Why? Because the majority of schools often have two levels of tuition fees. One for residents of the state or country you study in, and the other for non-residents. Without additional financial aid it is difficult to afford an international education.

Full ride scholarships pay the cost of tuition in full – plus, other expenses like fees, meals and housing.

In the US alone, according to the Fulbright Commission, over 600 universities offer scholarships worth $20,000 or more to international students. Around 250 schools in the US offer ‘full ride’ scholarships.

The Rotary Peace Fellowship is one example of a full-ride scholarship for international students. This scholarship covers tuition, fees, housing and travel costs. It also covers internship and field study expenses. It is for international graduates who want to pursue a master’s degree in areas related to peace, conflict prevention and resolution.

The process of applying for an international scholarship will vary from one school to another – or if you are applying with an external sponsor. There is some paperwork to complete in order to apply. As a student from another country, this may be complex as depending on your destination country you may need to fill out forms that are not in your native language.

In many cases you’ll want to make sure to practice your English writing skills if you are applying to attend school in an English-speaking country.

It is quite common for scholarship applications to require an essay to be submitted along with the paperwork.

Before you apply, do some research on the values held high by your intended school. Apart from good grades many schools are looking for students with character. Leadership, experience in work or as a volunteer, and good communication skills are also highly valued.

Do your best to communicate all of the above in your application and adhere to any special requirements the school or sponsor has. And make sure you stick to the application deadline as a late entry will not usually be considered.

For listings of scholarships for international students, see IEFA.org.

Many study abroad programs around the world offer scholarships. You should look for nonprofit organisations in your field and check your university website for their undergraduate and graduate scholarships listings.

The types of scholarship program available might depend on your status – whether you are studying abroad for a semester or full degree. Your status as an undergraduate or graduate student also plays a role in the type of scholarship you may be eligible for. Similarly with a phd scholarship.

In any case, the majority of international scholarships do not charge any application fees – if you are applying for a private scholarship and are asked for a payment up front in order to secure the scholarship, you should be very cautious and ensure that this is a reputable organization – be wary of scams targeting vulnerable international students.

Many countries have universities that offer scholarships to international students.

The United States is one of the most popular with students from other countries. But if you are an American and want to earn your degree abroad, there may be options too – just as if you are an international student in any country.

For example, if you want to study in China there are Chinese government scholarships. There are Bahrain scholarship for international students,

There are tuition-free public universities in Germany. Norway, Australia, Sweden are other countries that encourage international students to study there through incentives such as scholarships.

There are many uk scholarships for international students.

Find an extensive list of scholarship opportunities at IEFA.org/scholarships.

Information about Scholarships in Canada.

US Citizens studying abroad: Can You Get Financial Aid For Studying Abroad

International Students in the US: Financial Aid For International Students in the US: Explained

You may also be interested in reading about Engineering Scholarships.

Find Universities that offer full scholarships.

In this post we’re comparing studying as a foreign student in the USA with studying in Canada – if you’re interested in studying in either country then you’re in the right spot-as we will discuss some of the big advantages of studying in each.

Now let’s dive straight in!

A degree in Canada is just as good as a degree from the U.S., Australia, or the UK.

Canadian universities are doing well in international rankings and Canadian universities rate among the world’s top 50 universities.

There’s no question that a Canadian education is a world-class education, whether you’re attending a university, college, or technical school.

The most important obstacle for most students seeking to study abroad is the cost.

And while international students pay higher tuition fees at Canadian universities than domestic students, the average annual tuition for a Canadian undergraduate degree for a foreign student is considerably lower than in the United States , Australia, or the United Kingdom.

Foreign students must also find housing and support their everyday lives. The cost of living in Canada is quite affordable compared with many other top destinations for foreign students. And when you consider the average annual cost of living to be lower than other countries with also lower average annual tuition fees, Canada tends to be a really good opportunity, indeed.

It is possible to get an International Student Loan to study in Canada, too.

You can also search our database of scholarships for international students.

While Canada is a relatively affordable option globally, studying abroad is undeniably expensive.

International students in Canada are allowed to work up to 20 hours a week during school term and full time (30 hours a week) during scheduled breaks, such as holidays. Most students don’t have to get a work permit to work when studying.

Another big reason many students choose to come to Canada is personal safety. Studying abroad can be frightening, because you are leaving your family and friends – your safety net – at home. The Institute for Economics & Peace ranked Canada 8th most peaceful nation in the world. The location and relative isolation of Canada geographically provides a bit of a shield against most international disputes.

Canada has a freely elected government, and the Charter of Rights and Freedoms of Canada guarantees the fundamental rights and freedoms of those living in Canada. Canada’s worldwide reputation is as an inclusive and non-discriminatory society. Immigrants make up 20 percent of Canada’s entire population and Canadian regulations ensure that all citizens are protected from prejudice whatever their circumstances may be.

You typically get temporary status as a foreign student in the country where you are studying. You need to get back home when you graduate.

However, contrary to other countries, Canada has a variety of programmes that enable foreign students to be moved to permanent resident status after their studies. Options like the Post-Graduation Work Permit encourage students to live and work on an unrestricted work permit after graduation, which lets them gain some Canadian work experience. Most provinces in Canada have Provincial Nominee systems for applicants with studying or working experience in the province, and the point-based immigration scheme rewards Canadian job and education experience. Approximately half of all foreign students consider applying for permanent residency in Canada after completing their studies.

Canada is one of the world’s largest economies, and students are given plenty of opportunities to work. You have the chance to communicate with stakeholders of your chosen sector and network with them. And while you study, or after graduation, you could gain valuable experience working for industry-leading Canadian companies.

Your Canadian education and improved language skills in either English or French may provide global opportunities should you want to return to your home country or move abroad.

Canadian employers seem to prefer Canadian work experience over foreign work experience, so if you do chose to live in Canada your experience could make you stand out from other applicants!

It is estimated that 48 of the top 100 universities worldwide are in the USA. Flexibility in academic fields is one of the biggest factors which distinguishes US colleges from other universities around the world.

Usually, you are not required to specify your major until after your second year of study. Most students take advantage of these two years to explore different academic goals before deciding on a major. Students are expected in most other nations to determine their field of study before even applying.

Many U.S. colleges mandate that you take general or “core” education classes.

They provide you with the opportunity to learn about a wide range of academic topics – not just your major or concentrated research area. These classes, often entitled “liberal arts”, cover many subjects from writing to sciences and philosophy.

With an internship, you will get a head start on your career – opportunities are provided by most US colleges. You will gain hands-on experience and exposure to your profession in the real world, plus the possibility of better-paid jobs after graduation because you already have some experience in the job.

Read about working in the US

Colleges in the U.S. offer a wide array of sports , clubs, societies and events outside the classroom, so whatever you are interested in – you will find it right there on campus!

Students studying in the US come from all over the world. You’ll be able to meet new people from various backgrounds every day , learn new languages, make friends and learn about other cultures – and share your own!

Most schools have a dedicated office devoted solely to assisting their international students with any needs. They can help you develop your English, or deal with visa problems, financial support, and even help you adapt to cultural differences which can be quite a big deal in a new country.

When studying in the US one important thing to remember is that it can be very costly – far more costly than many other countries in the world. Through this article you will find out more about how to finance your education in the USA:::Link::

Then you can find out whether you qualify for a loan to study in the US:

You can also search our database of scholarships for international students.

And there you have it! Lots of great reasons why you would want to study in the United States or Canada! Let us know where you want to go in the comments below!

In this video we break down all the Financial Aid Opportunities for International Students in the US.

If you’re specifically looking for a loan, then you can use the tool on our site to see if you are eligible.

If you’re looking for a scholarship, then you can search through our database on our Scholarships Page.

It’s also the most expensive. International students have to pay for tuition, room & board, transportation, health insurance, books, and supplies – and international graduate students may not have all that money saved in advance.

So how can international students pay all these expenses? It’s not easy, but you can realise the dream of studying in the US with hard work and some financial aid.

The U.S. federal government gives international students limited financial support. But while most foreign citizens are not eligible for federal aid or government student support or federal loans, the U.S. Department of Education states that:

“Many non-U.S. Citizens qualify for federal student assistance. Don’t assume you can’t get help because you’re not a citizen.”

Under certain circumstances, non-citizens may be eligible for U.S. federal student aid funding. If you are applying for an international student visa, you may be eligible for the U.S. government-funded programmes:

However, as an international student, you are most likely not eligible for US government financial aid.

But there are other alternatives that can help fund your education.

Always start looking at home. If you’re an outstanding student with great potential, your own home country’s government may be willing to send you to an American college or university to learn at some of the best institutions, and then return home to apply your newly acquired skills.

To give you some examples of these programs:

You should talk to the education department of your home country for government aid and your US embassy or consulate to see if such aid or government-funded programs are available.

Universities are often flexible in offering financial aid options and support to international students. You can usually find plenty of international student financial aid information on the website of your school or by talking to your Admissions Office or International Student Services Office, or the Financial Aid Office.

You can find information on budgeting, the cost of your education, student financial aid application, resources and any financial support you can access.

For their students, most colleges have either need- or merit-based, financial assistance and aid packages, which can come in various forms.

Some schools have introduced a “need-blind” admissions policy, meaning you’re accepted based on your academic merits and don’t look at your financials.

It’s important to talk to your admissions office about what financial aid you ‘re eligible for. You may be aware of additional completion forms and deadlines.

Schools differ greatly in the international financial aid offered to students. If the school is well-funded, wants to diversify its student population, or has special interests in certain fields of graduate study, it may be willing to offer a generous financial aid package to attract international students.

International students can get up to a full scholarship to participate on their school’s sport teams. If you’re a talented athlete, this could be your ticket to a US school.

There are agencies travelling the world searching for students who have excelled in their sport and will match you with a coach recruiting for their school. The coach will have the final say as to whether you get selected — and whether there is a financial package to go along with that.

Many schools are looking and have the funds to build a specific academic department. Whether you excel in math, business, or physics, there may be a scholarship for you. You’ll need to contact the Department Head to see if they’re willing to help you. These scholarships are often available in STEM fields — science , technology , engineering, and mathematics. These departments are seeking new research and expertise, so you need to show your track record and make the investment worthwhile.

A tuition waiver allows students not to pay a portion of their tuition. While not all schools grant international students a tuition waiver, a handful to do. The school will specify the requirements to be met before international students qualify for a waiver of tuition. It can be based on citizenship, academic performance, or part of a fellowship or grant. Do your research, look at the school’s website, and talk to your admissions counsellor or an international student advisor to find out more about eligibility.

Many organisations worldwide have created scholarships and grants to offer aid to help students study abroad. But these awards can be competitive. There are thousands of scholarships and grants out there, but remember to put the time and effort into each application to increase the likelihood of winning the award. Have your application reviewed and submit as many as you can. You can search for international education scholarships on IEFA.org.

Working in the U.S. to supplement your financial support is difficult for international students. F-1 students may work part-time on campus if they are in good academic standing or have completed their academic programme. For OPT or CPT approval, your work must be directly related to your major. Check with your International Student Advisor if you can work during your studies.

If you pursue higher education degrees, some international organizations can help you study in the U.S., including the United Nations and the World Health Organization, to name a few. Again, these international scholarships are extremely competitive, but they can be amazing if you have the qualifications and skills to do so.

If you still need funds, there are international student loans that can cover your U.S. education’s total cost, including your tuition, transportation, some living expenses and food expenses. As long as you attend an accredited school, several lenders will work with international students. In most cases, you can apply online and get approval within days. Remember, international student loans allow you to borrow money, but you’ll need to pay back the money with additional borrowing costs. Check all the details and compare lenders to find the right international student loan.

The world we are currently living in is a society that thrives and depends heavily on computers and technology so this 2019-2020.

Gone are the days when we can function at our best without all the needed technological complexities. Now, we not only need the right equipment and computers but also the right minds to work on today’s tech-driven world.

That’s where Indeema comes in.

Indeema is a software company that develops business solutions for its clients using the latest tech. Aside from that, they also believe that having their own contribution to the industry can be best defined by offering scholarships.

Well, that’s just what they did as our friends at Indeema offers a scholarship program worth $1,000 for computer science students and to those who are studying STEM-related courses.

Indeema believes that investing in bright minds and aspiring talents, as well as sharing their resources and knowledge to the right people is one of the best things they can do for the upliftment of society.

To assist high school seniors or freshmen students in the USA, Indeema is offering the $1,000 Scholarship Program for enrolling at a university/ college for:

The company believes that it is in supporting students who are following a path towards computer and tech literacy is the future. Thus, those who are interested in enrolling in computer science, computer engineering, as well as other STEM-related programs, specifically in science, technology, engineering, and mathematics, are eligible to apply for of this scholarship fund.

Indeema is driven by their passion to not only cater quality tech business solutions to their clients but also positively contribute to the overall welfare of the industry. This is why the company’s mission is driving progress with tech skills and science.

The company also lead educational courses and collaborate with research institutions in Lviv and Austria. Furthermore, Indeema also believes that it is important for them to facilitate the development of fresh minds in the IT industry so that it will progress for the betterment of everyone.

Because of this, they decided to finally grant educational scholarships to students in the US who are interested in pursuing careers in computer science and other STEM courses. This is also a strategic move for the company as it is where their main office is located.

Indeema knows that starting can be hard. That’s why they want to create a stepping stone and encourage IT enthusiasts to build their career in this innovative landscape.

Not only will this create brighter minds in the tech industry, but this will also make it easier for them to leverage on their careers, and in the process, help Indeema and the entire tech sector improve.

Any wonderful product or disruptive innovation is done by people like you or like Indeema — passionate dream chasers.

Study hard and work smart, and there will be nothing you can’t achieve!

High school graduates who graduated from a public school are eligible. However, those who have graduated from a private school are also welcome as long as the school they’ve graduated in is accredited.

Students who are going to pursue a degree and career in computer science, computer engineering, and other STEM-related courses are eligible to apply for the scholarship.

Students who are already enrolled or have been accepted for enrollment for a four-year course at any accredited college and university in the US are eligible for the scholarship.

Students who have a high SAT score are eligible. Specifically speaking, only those who have SAT scores of 1350/1600 and above. Also, those that have a cumulative GPA of 3.0 as well as a 27 or higher composite ACT score are eligible for the scholarship.

If you are deeply passionate and interested in computer science, computer engineering, and technology, then you’re a great fit for the scholarship.

If you are interested you can find out more below. You must apply for the $1,000 Scholarship Program by March 1st.

Read more from our blog.

This award is brought to you by IEFA.org and all responsibility for the program lies with the provider – in this case, Indeema. For more information see the listing on IEFA.org and contact the provider directly.

University of Arizona

Deadline: April 1st

The University of Arizona is one of the United States’ most respected public research institutions. The UA provides more than a world-class education, they help students develop the necessary skills of discovery, research, and creativity and that’s why you can’t miss this opportunity to study there!

What’s the scholarship about?

In recognition for students who exhibit an outstanding academic performance, the University of Arizona offers the International Tuition Award which offers $4,000 – $24,000 per academic year for freshman, and $5,000 per academic year for transfer students.

Eligibility:

If you meet the criteria, be sure you submit your application on time for the next fall semester!

Get more details on the University of Arizona International Tuition Award and how to apply.

Westbon

Deadline: October, 15

Westbon is the first lending platform for international students in the U.S. Based in Chicago, they specialize in providing auto loans and personal loans for their customers, who have always been an underserved group due to their lack of a Social Security Number (SSN) and credit history.

Westbon is dedicated to assisting international students in their pursuit to study in the United States and is always amazed by how vibrant and talented the international student community is.

To help international students further pursue their dreams in the U.S., Westbon has established a scholarship program for international students who are on F1 Visa in the United States. Regardless of your fields of study, Westbon is happy to offer the assistance you need for your college studies in the United States.

Eligibility

To qualify, you must be:

What are they looking for?

Applicants who have the excellent achievement and great potential in academic, extracurricular activities or social fields.

Academic

Adventurous/ Creative

Social Impact/ Leadership/ Entrepreneurship

All undergraduate and master program students are welcome to apply. You can find further details here.

Full Sail University

Deadline: Applications must be submitted prior to the desired start date

Full Sail University is an American private, for-profit university located in Florida. Full Sail is dedicated to helping creative students follow their dreams in the entertainment and media industry. With students from over 65 countries, 110 world-class recording studios, and many spacious film soundstages, Full Sail’s innovative and accelerated style of education provides a unique real-world education in film, music, animation, video games and recording arts.

Full Sail University is offering students the opportunity to apply for the Full Sail Global Achievement Scholarship, which is designed to encourage and develop future international entertainment and media professionals throughout the world.

What is it?

Through the Global Achievement Scholarship, eligible participants may receive up to $5,000 toward the tuition of their Full Sail campus degree program. If you are interested in attending Full Sail University and applying to this scholarship find more information about it here.

Eligibility

To be eligible you must:

How to enter

Get more details on this scholarship and how to apply.

East Tennessee State University

Deadline: January 2nd

If you are a new international student at East Tennessee State University (ETSU) or if you are planning to apply to ETSU, we have great news for you! The International Students Academic Merit Scholarship is open to new international students seeking a graduate or undergraduate degree.

What is it about?

The scholarship covers 50 percent of total in and out-of-state tuition and maintenance fees only. No additional fees or costs are covered (recipients will be required to pay other fees such as program fees, course fees, housing costs, and medical insurance costs).

Students must apply for admission to ETSU before applying for the scholarship. Once an admissions application is submitted, the student may then apply for the scholarship. A student’s scholarship application will be reviewed once the student is admitted to the university.

The scholarship is available for:

To be eligible, students must:

Also important to know:

Time is running out so if you are interested, be sure to submit all your information by January 2nd. Applications received after the deadline will not be reviewed. You can find further details here.

One great way to establish credit is by obtaining a credit card. Having a credit card and making frequent, small purchases then immediately paying off the balance can help build credit as an international student in the US. However, without a social security number or established credit, new international students may find it difficult to open a credit card.

One option that you’ll want to explore is SelfScore. SelfScore was established by former international students, for international students. They offer the only MasterCard designed specifically for international students, which means you do not need a social security number to apply and you can count on them always offering you fair credit.

SelfScore offers two types of MasterCard: The Classic and The Achieve. With both of these cards you can enjoy:

SelfScore prides themselve on “opening the door of the US financial system for international students.” See if a SelfScore MasterCard can help you establish your credit during your time in the US.